The Best Strategy To Use For Medicare Advantage Agent

Table of ContentsAll about Medicare Advantage AgentThe 2-Minute Rule for Medicare Advantage AgentThe Best Guide To Medicare Advantage AgentThe Ultimate Guide To Medicare Advantage AgentMedicare Advantage Agent Things To Know Before You BuyA Biased View of Medicare Advantage Agent

If the anesthesiologist is out of your health and wellness plan's network, you will certainly obtain a surprise costs. This is also known as "equilibrium payment." State and federal laws secure you from shock clinical bills. Find out what bills are covered by surprise billing legislations on our web page, Exactly how customers are protected from surprise medical bills For more details concerning obtaining help with a surprise bill, visit our page, How to get assist with a surprise clinical expense.You can use this period to join the strategy if you really did not earlier. Plans with greater deductibles, copayments, and coinsurance have reduced premiums.

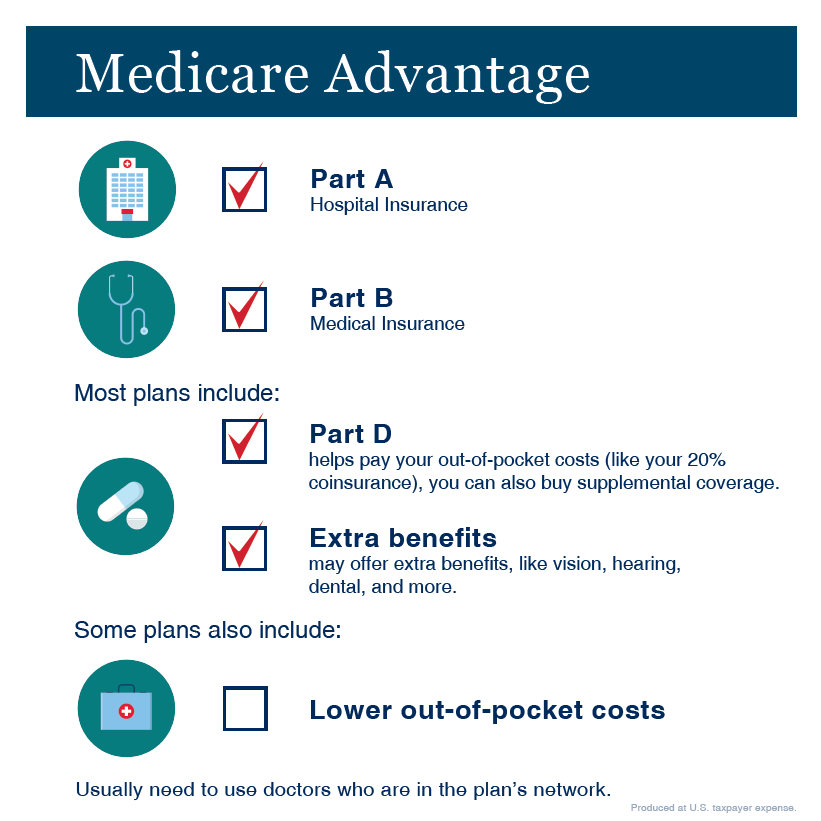

Know what each plan covers. If you have physicians you desire to maintain, make certain they're in the strategy's network. Medicare Advantage Agent.

The Best Guide To Medicare Advantage Agent

Likewise make sure your medications get on the strategy's checklist of approved drugs. A strategy won't pay for medications that aren't on its listing. If you lie or leave something out on objective, an insurance provider might cancel your coverage or refuse to pay your cases. Use our Health insurance plan shopping overview to shop smart for health coverage.

There are different warranty organizations for various lines of insurance policy. The Texas Life and Health Insurance coverage Warranty Association pays claims for wellness insurance policy. It will pay claims approximately a dollar restriction set by regulation. It doesn't pay cases for HMOs and a few other kinds of plans. If an HMO can't pay its cases, the commissioner of insurance coverage can assign the HMO's members to one more HMO in the area.

Your partner and youngsters also can continue their insurance coverage if you go on Medicare, you and your spouse divorce, or you die. They should have gotten on your strategy for one year or be younger than 1 years of age. Their coverage will certainly finish if they obtain various other protection, don't pay the costs, or your employer quits using health and wellness insurance.

Not known Factual Statements About Medicare Advantage Agent

You should inform your company in composing that you want it. If you continue your protection under COBRA, you need to pay the premiums yourself. Your employer does not need to pay any one of your costs. Your COBRA coverage will be the very same as the insurance coverage you had with your employer's plan.

As soon as you have registered in a health insurance plan, make sure you recognize your strategy and the cost implications of various procedures and solutions. Going to an out-of-network doctor versus in-network commonly sets you back a customer much more for the very same kind of service (Medicare Advantage Agent). When you register you will certainly be given a certification or proof of protection

6 Easy Facts About Medicare Advantage Agent Shown

It will also tell you if any solutions have limitations (such as maximum amount that the health insurance will pay for sturdy clinical devices or physical treatment). And it ought to inform what services are not covered whatsoever (such as acupuncture). Do your homework, research all the options available, and assess your insurance policy prior to making any choices.

The Definitive Guide for Medicare Advantage Agent

When you have a medical treatment or browse through, you usually pay your healthcare company (medical professional, hospital, specialist, etc) a co-pay, co-insurance, and/or an insurance deductible to cover your section of the provider's bill. You anticipate your health plan to pay the rest of the expense if you are seeing an in-network copyright.

Nonetheless, there are some situations when you might have to sue on your own. This can happen when you go to an out-of-network service provider, when the company does decline your insurance policy, or when you are traveling. If you require to submit your very own medical insurance case, call the number on your insurance card, find more information and the consumer support representative can inform you exactly how to submit a claim.

Numerous health insurance have a time limit for exactly how long you need to sue, generally within 90 days of the service. After you submit the case, the health insurance has a minimal time (it varies per state) to notify you or your supplier if the health insurance plan has accepted or denied the case.

Getting My Medicare Advantage Agent To Work

If it decides that a service is not medically needed, the plan may deny or minimize settlements. For some health insurance, this clinical necessity choice is made prior to treatment. For other wellness strategies, the decision is made when the business gets an expense from the provider. The business will certainly send you an explanation of advantages that lays out the service, the amount paid, and any additional quantity Find Out More for which you might still be liable.